MONEY

A Step-by-Step Guide to Create a Home Renovation Budget that Fits Your Dreams (and Your Wallet’s Realities)

September 6, 2022

Is the kitchen or bathroom in your home starting to look and feel a little outdated? Maybe you’ve started working from a home and need to add a home office. Or perhaps you’ve recently welcomed a child or children, and want to child-proof the home. It might be time for a home renovation!

But pause before you start tearing down walls, picking new paint colors, or scheduling contractors. While renovating your home can make it more appealing or functional, and improve your quality of life, it often doesn’t come cheaply, and expenses could easily get overwhelming and out of control if you are not careful.

In this guide, we'll walk you through the steps of creating a renovation budget that works for your dreams and, most importantly, your wallet.

Step 1: Determine the Scope of Your Project

The first step in creating a home renovation budget is to determine the scope of your project.

For example, are you planning a major renovation like raising your roof ceiling or redoing your entire electrical and plumbing system, or are you just making a few cosmetic changes such as changing your wall colors or replacing your cabinet doors?

Ask yourself what your goals are, or what you hope to achieve from the project, and then make a list of all the tasks you hope to include in it.

Once you’ve compiled your list of tasks, order them by priority. At the top of the list, for example, you can include tasks or items that you consider "needs." These could be tasks or items that your renovation would simply not be complete without, tasks that are related to the functionality and safety of your home, or that will improve your quality of life.

At the bottom of the list, you can include tasks or items that are more "wants" than necessities. These are things that it would be nice to include in your project but that you can also live without.

If you are renovating your kitchen, for example, installing new cabinets, countertops, and new flooring could be put at the top of your list, while buying new appliances may be lower in priority.

The purpose of ordering your items by priority or separating them into “needs” and “wants” is to help you figure out what's most important for the project and what can be put on the back burner or even left out entirely if the estimated costs of your project ends up exceeding your budget.

Step 2: Estimate the Costs of the Project

Now that you have established the scope of your project and figured out what your priorities are, the next step is to estimate how much the whole thing will cost you. You can do that in a number of ways.

One of your options is to get quotes from nearby stores and from friends, family members, or neighbors who might have completed similar projects. For example, after compiling a list of all the materials you think you will require for the project, you can visit a couple of hardware stores in your area and get quotes for them.

The other option is to use a resource like Home Advisor. On this site, you can find cost estimates for almost all types of home renovations. Here are a few examples of home renovations and their estimated costs from Home Advisor.

Estimated Cost Ranges

- Remodeling a Kitchen: $13,387- $38,312

- Remodeling a Bathroom: $6,610 - $16,619

- Remodeling a Basement: $12,208- $33,398

- Painting Your House’s Interior: $950 - $2,912

- Installing or Replacing Countertops: $1,852 - $4,320

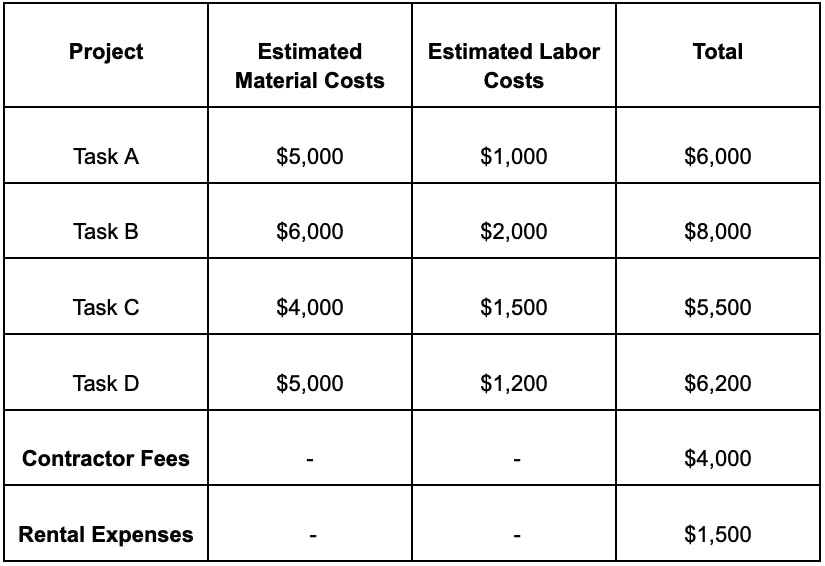

You can use a spreadsheet to break down the estimated costs for each project task.

The spreadsheet can have 4 columns, for example. The first column can be for the project tasks. For a bathroom model, project tasks can include installing new tiles, installing new countertops, changing the shower heads, and any other needed items.

The second column can be for estimated material costs, the third of labor costs, and the final one for the total costs for each task.

Make sure to also factor in other miscellaneous expenses in your cost estimates (e.g. rental expenses if you will have to move out of the house during the duration of the project).

Your spreadsheet can look something like this.

Step 3: Determine How You Will Be Financing the Project

You shouldn’t start a renovation project without a clear understanding of how you will finance it. After all, you don't want to start a project only to have to halt it midway due to a funding shortfall or delay.

There are multiple ways to finance a home renovation. The most common options are listed below. Consider each carefully to see which is the best one for your situation.

Cash

This is by far the safest option and the cheapest way to finance your home renovation. The advantage of using cash is that you don’t have to worry about getting into debt or messing with your home equity. At the same time, depleting your entire cash reserve means that you might be financially vulnerable if you were to face an unforeseen emergency.

Home Equity Line of Credit (HELOC)

A HELOC is basically a revolving line of credit that is secured against your home’s equity. With a HELOC, you can withdraw money as you need it, up to an allowed maximum amount. You will only pay interest on the amount that you borrow.

Since it’s secured against your property (unlike an unsecured line of credit like a credit card), it usually comes with a lower rate of interest. Its interest may also be tax-deductible.

Home Equity Loan

Also called a second mortgage, a home equity loan, like a HELOC, is extended against the equity in your home. But unlike a HELOC, where you can draw out money as you like, with a home equity loan, the money is paid out in a lump sum with set terms and a set monthly payment.

Cash-Out Refinance

This is where you basically replace your current mortgage with a new one with a higher balance. You will receive the difference in cash, which you can then use to fund your home renovation.

Credit Card

For minor home improvement projects, you can also opt for the sheer convenience of plastic.

If you decide to use a credit card to fund your project, try to use a card with a lengthy 0% APR introductory period so that you have sufficient time to pay off your balance without incurring interest charges.

Personal Loan

You can also apply for a personal loan from a bank, a credit union, or an online option like Happy Money to fund your project.

Unlike a HELOC or a home equity loan, these loans are unsecured. The application process is likely to be faster, and you are likely to get your money sooner. Keep in mind, however, that your credit score will largely determine your qualification for a personal loan, as well as the interest rate you get.

Step 4: Compare Estimated Costs With Your Budget

To start, determine how much you are willing to spend on the project. This will, of course, be determined by the amount of money you have saved or that you are sure of getting from your chosen financing option.

Once you have the number, compare it with the total cost estimates from Step 2.

Does everything you want to do fit within your budget? If the answer is yes, you are ready to proceed to the next step.

If the answer is no, you have some work to do.

Go back to your spreadsheet and analyze each line item. Are there any lower priority items or tasks you can eliminate to reduce costs?

Sometimes, you might not even need to eliminate a task entirely. Maybe you can complete the task with less expensive material. If you are retiling your bathroom, for example, you can opt for granite tiling in place of marble tiling due to the lower average cost of the former.

Make whatever adjustments are needed to align the project’s costs with your budget.

Have a Contingency Fund

One common mistake that many homeowners make when planning a home renovation is failing to budget for unexpected expenses.

Something may go wrong or cost more than was originally planned or estimated during the renovation. Make sure to budget an additional 10% to 20% to serve as a safety net for any project overruns and unanticipated costs.

Step 5: Ask for Bids (If Hiring an Outside Contractor) and Make Your Pick

With your renovation plan and budget in place, it’s now time to hire a contractor to start work on the project.

To find a potential contractor, you can ask trusted friends, family members, neighbors, and tradespeople for recommendations.

Alternatively, you can use sites like Home Advisor and the National Association of the Remodeling Industry to get the contacts of qualified pros near you.

Compile a list of 3–5 contractors and request that they send you a detailed bid for your project. Compare the bids you receive to your budget to see which ones match or come close to matching it.

When selecting a contractor, don’t base your decision on cost estimates alone, i.e., don’t simply select the one who sends in the cheapest bid.

A contractor may be cheap for a reason; they may be using inferior materials or equipment, which could translate to poor quality work.

So, before you settle on any one contractor, make sure to also check out their:

- Experience and expertise

- Recent work samples that are similar or closely related to your project

- Reviews from previous customers

Basically, take time to really understand what each contractor has to offer and if they have what it takes to handle the project.

If your preferred contractor's project estimates are higher than your budget, use a bid from a competitor to try and negotiate a lower amount.

Of course, it’s also possible that none of the bids you receive will match your budget. That could mean that you have probably underestimated the costs of your project.

In that case, you will need to revisit your tasks and costs spreadsheet again. Next to each cost column in the spreadsheet, add another column and label it “actual costs''. Use the figures quoted by contractors to fill out the additional columns.

This will now give you a true and accurate picture of how much your renovation will cost. With this information, you can make additional changes to your renovation plan (for example, by eliminating even more lower priority tasks) to align the overall costs with your budget.

Of course, if you are able to obtain a bid that matches your budget from a contractor who checks all of the boxes, you'll not need to do all this. You can go right ahead and hire them and commence your project.

Step 6: Celebrate the Journey

Renovating your home is no easy task, as you have probably realized by now. It takes time, effort, and money to turn your vision into reality. So when everything is done, don’t forget to take a moment to celebrate your hard work—you've definitely earned it.

Get even more financial tips and insights by checking out our other articles, offering up tons of helpful financial tricks to keep you on the path of using money as a tool for happiness.