MONEY

Credit Card Debt Consolidation Explained

November 13, 2025

Credit card debt consolidation is the process of combining multiple credit card balances into a single repayment method. Unlike general debt consolidation, which can include medical bills or other types of personal loans, this strategy focuses specifically on paying off revolving credit card balances.

The goal is to replace high-interest card payments with one structured plan—often through a personal loan, balance transfer, or another consolidation tool—that makes repayment more predictable and potentially less expensive.

Now that you understand the basics, let’s explore how credit card debt consolidation works.

How Does Credit Card Debt Consolidation Work?

Here’s how the process works to consolidate your credit card debt:

- Step 1: Review your debt. Assess your credit card debt, including total balance and interest rates.

- Step 2: Pick your method. Choose a consolidation method, such as applying for a personal loan or transferring balances.

- Step 3: Pay off your cards. Use the new loan or balance transfer to clear your existing cards.

- Step 4: Repay under your new loan terms. Make one monthly payment toward your consolidated balance.

For example, you might consolidate $10,000 across three cards into one personal loan, simplifying your monthly payment.That’s exactly what The Payoff Loan™ was designed to do.

Benefits of Credit Card Debt Consolidation

Consolidating credit card debt can make repayment easier and more affordable. Here are the benefits:

- Lower interest costs: Credit card APRs often top 20%. A personal loan or balance transfer can reduce what you pay in interest.

- Single due date: Fewer bills to track means less stress and a lower chance of late fees. Consolidation simplifies your financial obligation to one monthly payment.

- Clear payoff timeline: Unlike revolving balances, consolidation loans have fixed payoff timeliness so you can see real progress toward being debt-free.

- Support for your credit health: Consistent on-time payments can help improve your score over time by lowering utilization across multiple cards..

Consolidation can save you money, simplify your life, and give you a repayment plan that feels achievable.

Potential Considerations to Keep in Mind

While credit card debt consolidation can create a clearer repayment path, it is not without important considerations:

- Fees and costs: Balance transfer may come with fees, and some personal loans may include origination fees.

- Credit requirements: The best rates usually go to those with stronger credit score and history.

- Temptation to spend again: Unlike installment loans, credit card debt is revolving, meaning old or paid off accounts remain open and reusable. If balances are run up again, progress from consolidation can quickly be undone.

- Longer repayment: Stretching out a loan term may lower your monthly payment but can increase total interest paid over time.

When Credit Card Debt Consolidation Makes Sense

Credit card debt consolidation is most effective when it reduces costs and simplifies repayment. It’s often a good fit if:

- Your credit card APRs are higher than the rates you could qualify for with a loan or balance transfer.

- You’re juggling multiple due dates and want one simple payment.

- Your credit score and history can qualify you for lower rates and better terms.

- You can commit to repayment.

- You’re ready to make lasting changes to how you manage credit.

Top Credit Card Debt Consolidation Options

When these factors line up consolidation can help replace scattered debt with a clear payoff strategy. Next, let’s look at the leading consolidation options available.

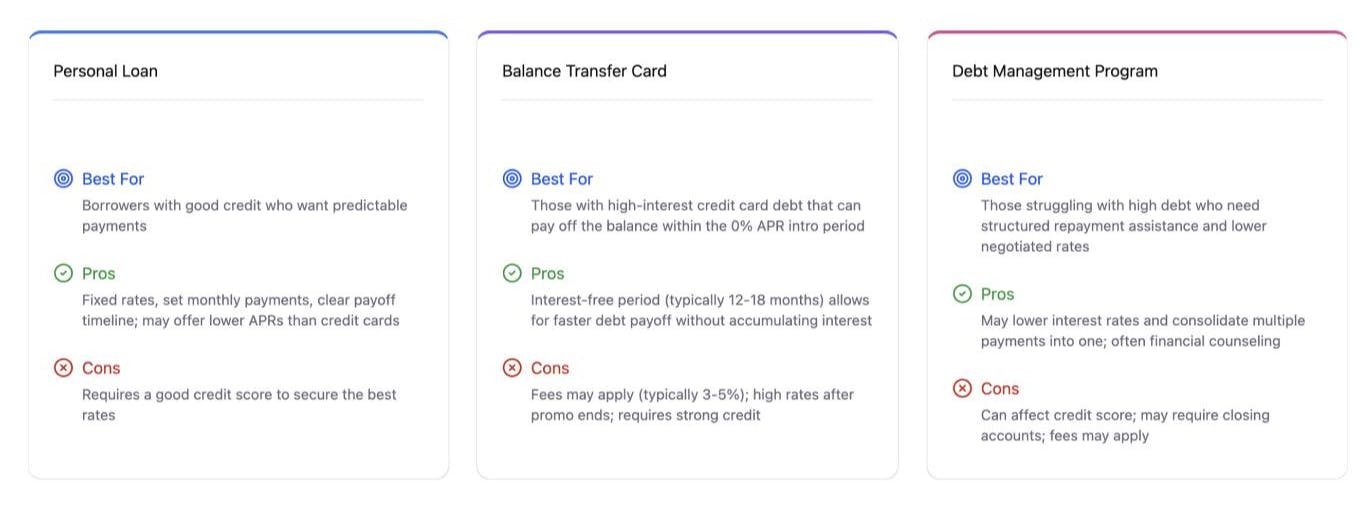

The main options for managing credit card debt generally fall into three categories: a personal loan, a balance transfer card, or a debt management program. Each method has its own advantages and trade-offs, and the best fit depends on your budget, your credit profile, and how quickly you want to pay off your balances.

Here’s a comparison of the top credit card debt consolidation options:

No single method is right for everyone, so it's important to find the best fit for your situation. A personal loan provides fixed payments and a clear payoff date, which many borrowers find easier to manage. A balance transfer can offer short-term relief if you can pay down debt during the introductory period. Debt management programs may help those who need structured support and reduced rates.

By carefully weighing personal loans against other financial options, you can choose the best path to simplify your payments and reduce the burden of credit card debt.

Common Consolidation Mistakes to Avoid

To get the most out of consolidation, avoid these common pitfalls:

- Treating consolidation like a reset button: Don’t run up balances on newly cleared cards. Spending within your means is a smart money move.

- Ignoring your budget: Without a plan to control spending, balances may creep back up despite lower payments. Support your budget with wise financial strategies so you feel confident in sticking to your goals.

- Focusing only on your monthly payment: A lower monthly bill can sometimes mean higher long-term costs, so consider all the factors in your loan terms.

- Picking the wrong repayment structure: A balance transfer only helps if you can pay it off before the promotional period ends.

By avoiding these mistakes, you can approach consolidation with more clarity and confidence. For many people, a well-structured personal loan offers predictability and long-term savings, making it one of the most reliable ways to manage debt effectively.

How to Compare Credit Card Consolidation Options

When choosing between personal loans, balance transfers, or other tools, it’s important to look beyond the headline rate. Be sure to compare them on the same terms:

- Match to your goals: Do you want fixed payments and a defined payoff date, or short-term relief with a balance transfer?. Debt management programs may suit you if you want coaching and negotiated rates.

- Look at the true cost: Compare total repayment, including interest, fees, and repayment terms. Estimate total repayment so you can compare options apples to apples.

- Check eligibility and terms: Make sure your credit score aligns with the terms offered. Confirm whether terms are fixed, how fees are calculated, and what happens if payments are missed.

- Be honest about habits: A balance transfer keeps debt revolving during the promotional period and only saves money if you avoid new charges and pay the balance before the window ends.

Taking time to evaluate each factor gives you a clearer picture of affordability and sustainability. Make sure the option you choose supports lasting financial progress before you take action.

How to Get Started with Credit Card Debt Consolidation

Once you have chosen the right consolidation option for you, you’re ready to take the next step:

- Gather your details: List each card’s balance, APR, due date, and account number so you know exactly what you are paying off.

- Select a provider: Choose a lender, card issuer, or counseling agency that fits.

- Apply and review terms: Submit your application, review all fees and conditions, and accept only if the numbers make sense for your financial plan.

- Pay off your balances: Use the loan funds or transfer to clear credit card balances.

- Stay on track: Set up autopay to simplify repayment and keep your spending in check to make progress toward your financial goals.

Once your application is approved and your repayment terms are set, knowing what comes next can help you keep progress steady.

What to Expect After Consolidating Credit Card Debt

Consolidation can be a powerful step forward, but progress takes time. Keep these expectations in mind:

- Credit score may dip at first: Opening a new account may cause a short-term dip but steady payments help your score improve over time.

- Your spending habits matter: Consolidation works best when paired with mindful spending and steady progress on your new balance.

- Budget is key: Tracking expenses and sticking to a plan is what turns consolidation into real, lasting progress.

- Debt repayment takes time: While consolidation changes the structure of your debt, on-time payments are keys to success.

By approaching consolidation with clear expectations, you can use it as a foundation for long-term financial progress rather than a quick fix.

Ready to simplify your debt?

Apply for a personal loan to consolidate your credit card debt.

- Personal loans between $5,000 - $50,000‡

- Rates as low as 7.95% APR‡

- Pay it off in 2-5 years**