Are Credit Card Rewards Worth It?

January 12, 2023

Credit cards are exceptionally common in America. In fact, over 83% of American adults have at least one credit card.

And while using credit can of course lead to debt, there are some significant perks of using a credit card. For instance, many cards earn rewards for each purchase you make. But are credit card rewards worth it? It really all depends on how the credit card is used. Here’s what you need to know.

How Do Credit Card Rewards Work?

Many credit cards offer rewards whenever you make a purchase using the card. In most cases, you earn a certain amount of rewards for each dollar you spend.

For instance, you might earn 1 airline mile per $1 you spend. Or, you might earn 1% in cash back on every purchase — meaning $0.01 per $1 you spend. On certain credit cards, rewards are earned for making purchases. It doesn’t matter whether you pay off the balance in full or pay it off over time.

Types of Credit Card Rewards

Cash back: Cards offering cash back give you a percentage back on every transaction you make. For instance, a card might offer 1% or 2% back on all purchases. Cash back is usually redeemable in the form of a statement credit, which lowers the balance of your credit card. If you have a $100 credit card balance and redeem $20 of cash-back rewards, your balance will be lowered to $80.

Airline miles: Many travel rewards cards earn airline miles for every dollar you spend. In most cases, this is one mile per $1 spent. Many major airlines have their own credit card which earns miles in the corresponding airline loyalty program. There are also cards that are not specific to one company and allow you to redeem miles on a variety of airlines.

Flexible rewards points: Many cards earn rewards points that can be redeemed for a variety of perks. Often, you’ll earn 1 or 2 points per $1 spent, and points can later be redeemed for cashback, gift cards, hotel stays, and more. In some cases, these points can also be converted into airline miles.

Tiered rewards: Some cards offer a tiered rewards structure that earns a different rate of rewards depending on the spending category. For example, a card might earn 3% on travel purchases, 2% on gas, and 1% on everything else.

Are Credit Card Rewards Worth It?

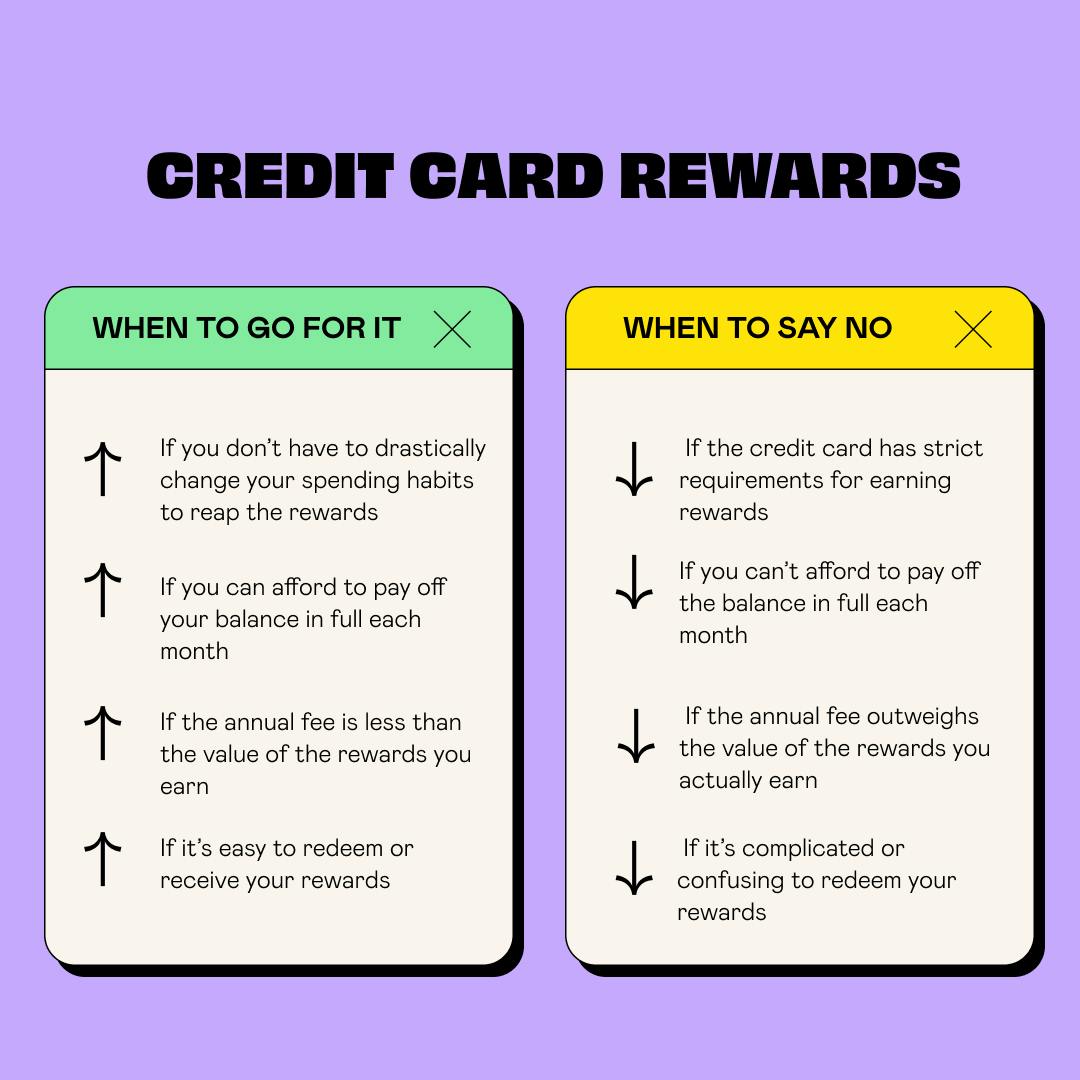

Ultimately, credit cards are worth it when:

- You don’t have to drastically change your spending habits to earn them

- You can afford to pay off your credit card balance in full each month

- The card has no annual fee or a low annual fee (for example, the value of your rewards exceeds the total costs of the credit card including any annual fee)

- It’s easy enough to redeem rewards for something you actually want or need

When credit cards are used responsibly, the rewards they earn can simply be a helpful side perk. Rewards might not make a huge difference to your finances, but they require minimal effort to earn.

For example, let’s say you spend around $2,000 per month on expenses that can be put on a credit card (groceries, bills, etc.) If you have a 1% rewards card, that’s around $20 per month that you can earn in cash-back rewards.

If you have an airline rewards card, that same monthly spend would likely earn you around 2,000 airline miles. You can eventually redeem these miles for free or discounted flights. Most airline miles are worth somewhere in between 1 and 2 cents per point, but the details vary significantly depending on the program. Plus, you often have to save up a lot of miles before you can actually redeem them for a free ticket. If you pay off your full credit card balance each month, you won’t owe anything in interest. In this case, the rewards are just a free side perk.

However, rewards should not be a motivator to use a credit card if you know you can’t pay off the full statement balance. The cost of interest will easily outweigh the benefits of the rewards points. Using the same example from above, $2,000 in credit card debt at 24% APR will accumulate $40 in interest in a single month.

In short, rewards are a great perk if you can afford to pay off your full balance each month. If you can’t, rewards are far outweighed by the cost of interest on credit card debt – not to mention the potential negative impact that an increasing credit card balance can have on your credit score.

Do You Have to Carry a Balance to Earn Rewards?

No, you do not have to carry a balance or pay anything in interest in order to earn rewards. Rewards are earned when you spend money using a credit card and have nothing to do with how you repay your debt.

How to Maximize Credit Card Rewards to Your Advantage

To get the most out of your credit cards, here’s what to consider.

- Pay off your balance in full each month. This will allow you to earn rewards, without paying interest.

- Look for a rewards card with a low annual fee. Some credit cards have a high annual fee, which may offset the benefits you get from rewards.

- Use rewards programs that are useful to you. If you travel frequently, this might be an airline rewards program — but for most people, cash back is the most versatile choice.

- Pay attention to category rewards. Some cards offer bonus rewards for certain spending categories, such as restaurants.

- Avoid considering rewards as part of your purchasing decisions. Ultimately, you should stick to earning rewards on purchases that you already planned to make — and avoid the temptation to overspend in order to earn additional rewards. Other things to look out for are expiring rewards, blackout dates, and other limitations in the fine print.

Use Credit Responsibly to Maximize Benefits

Rewards can be a great perk, but their benefits can easily be outweighed by the downsides of credit card debt. Credit cards can lead to high-interest debt, which can be a huge burden on your finances.

If credit card debt is holding you back, consider the Payoff Loan™ from Happy Money. The Payoff Loan is a personal loan designed to help pay off credit card debt at a lower interest rate.